Last updated 2/20/2025

When you inherit an IRA from your spouse, meaning you are specifically named as a beneficiary (not a trust that you are the beneficiary of), you’ll be faced with a set of important yet complicated decisions to make.

You and/or your advisors will want to understand the rules around inherited IRA RMDs as a spouse and the options available. The key is not to rush to get a hold of the money without first understanding the options available to you.

Required Minimum Distributions (RMD)

Before we dive any further into this, you’ll want to make sure you have a basic understanding of what are called Required Minimum Distributions.

Required Minimum Distributions – or RMD for short – are a minimum amount that an account owner must distribute out of most retirement accounts annually, beginning at what is called your Required Beginning Date – or RBD for short.

As of the passing of the Secure Act 2.0, your Required Beginning Date will be April 1st of the year following the year you turn either age 73 or age 75, depending on when you were born. These are the current laws as of the latest iteration of the Secure Act 2.0.

| RMD Age | |

| Age 73 | Born on January 1st, 1951 – December 31st, 1959 |

| Age 75 | Born on or after January 1st 1960 or later |

In the year you reach age 73 or 75, you are required to take your RMD, but technically you have until April 1st of the following year to take it.

However, if you opt to wait and take it sometime in the first quarter of the following year, you will have two RMDs to take! Tricky, we know.

This is because after your initial RMD year, you are required to take your RMD by December 31st each year thereafter, and that would technically be your second year.

The RMD is a minimum amount that you are supposed to take out of your retirement accounts each year. That being said, you can always take more if needed.

Roth IRAs and as of 2024 Designated Roth Accounts – or DRA for short – are not subject to RMDs and therefore there is no Required Beginning Date for a Roth owner.

A designated Roth account is a Roth account that is part of an employer retirement plan such as a 401(k) or 403(b) or 457(b) to name a few. Inherited/beneficiary Roth accounts are different, we will get to that later.

The dollar amount of your RMD is essentially calculated using your retirement account ending balances as of December 31st of the year prior, and your life expectancy factor per the IRS’s life expectancy tables.

There are different life expectancy tables the IRS has and the one you use will depend on your specific circumstances.

They are the Uniform Life Expectancy Table and Single Life Expectancy Table (partially included in our 2025 free guide)

The RMD is a moving target and will change each year dependent on each of those factors.

So what’s the big deal about RMDs? Well if you do not take at least the required minimum amount out each year, as of the Secure Act, you will be assessed a 25% penalty on the amount you should have taken out! This is in addition to the regular income taxes you will be subject to! Don’t forget about that part!

It is worth noting that the 25% penalty can be reduced to 10% if it is timely corrected, however we will save the nuanced details on this for another post.

In addition, the Secure Act 2.0 changed the statute of limitations to assess the missed RMD penalty to 3 years. That 3 year period starts with the tax filing deadline (not including extensions) for the year in which the RMD was missed.

Example: You miss your 2024 RMD for whatever reason, your statute of limitations will run 3 years beginning April 15th 2025.

The bottom line is that you should make sure your RMD is met each and every year once you reach your applicable RMD age to avoid any potential issues and unnecessary taxation.

Advantages of Inheriting a Retirement Account From a Spouse

As a surviving spouse you have more flexibility compared to other types of non-spouse beneficiaries when it comes to the options for inheriting your deceased spouse’s account.

As the surviving spouse you are considered what is called an Eligible Designated Beneficiary (EDB) – Think of yourself as the king or queen in the kingdom of beneficiaries.

Let’s start by going over IRAs in particular.

The main advantage of inheriting an IRA as a spouse is that you have a few options:

- Treat the inherited IRA as your own IRA by titling it in your name

- This is only possible if the surviving spouse (you) was the only listed 100% primary beneficiary

- Spousal direct rollover (or direct transfer) to your own existing IRA

- A viable option when there are multiple primary beneficiaries listed including the surviving spouse

- Keep the account as an “inherited IRA” aka “beneficiary IRA”

- Note: A surviving spouse is also able to rollover their inherited IRA to their own IRA after the fact which might be advantageous depending on your situation.

Option #1: Treat the IRA as your own IRA, or Direct Rollover to Your Own IRA

In the case you decide to treat it as your own IRA or process a direct rollover into your own already existing IRA, you would NOT be forced to start taking those pesky RMDs out of the IRA until you reach your required beginning date (unless of course you are already passed that date).

This means that you won’t be forced to recognize taxable income each year if you don’t necessarily need the money. Therefore, you can keep the money invested in the account and allow it to compound tax deferred for longer.

If unfortunately you are a widow or widower younger than age 59.5 and elect to treat your deceased spouse’s IRA as your own and take distributions, there may be a 10% early withdrawal penalty. If you think you may need the money early, you might want to explore an alternative option discussed later.

There is no time limit for you to process this rollover and this can be done whether or not your deceased spouse died before or after their required beginning date. However, after this is done, the funds cannot be rollover back to an inherited IRA. This is an irrevocable decision.

This can be very advantageous for surviving spouses in certain situations. This is due to the tax and investment planning flexibility that’s available during years where RMDs are delayed. Again, this will be specific to your exact situation so always consult a financial advisor first.

As the survivng spouse, once the inherited funds are in your own IRA (and not titled as an inherited IRA), your RMDs will be required to be taken by your own required beginning date and you will calculate it using the Uniform Life Expectancy Table recalculating annually.*

*Note: If a surviving spouse treats the inherited IRA as their own or rolls the money to their own IRA, remarries someone more than 10 years younger, and names this spouse as the sole beneficiary of the IRA, RMDs will be calculated using the Joint & Last Survivor Table (see PDF pg. 50) rather than the Uniform Life Table.

It’s also important to note that if your deceased spouse died after their required beginning date and had not yet taken their full Required Minimum Distribution during the tax year (known as the “year-of-death RMD”), then you will need to take the remaining RMD on their behalf.

Surviving spouse is the beneficiary of a trust that is the beneficiary of the IRA:

Lastly, if a trust is named the beneficiary of the IRA, and you as the surviving spouse are a beneficiary of that trust, you generally cannot roll the account over into an IRA in your own name. In many of these cases, the trust is the first beneficiary not you.

In addition, the IRA funds shouldn’t be fully “distributed” from the IRA to the trust all at once in order for the surviving spouse trust beneficiary to receive. This would cause a fully taxable event which often times is not in the beneficiary(ies)’s best interest.

Generally in these cases, an inherited IRA is created for the benefit of the trust, any distributions from the inherited IRA are paid first to the trust, then the trust distributes funds to the beneficiary(ies) per the terms of the trust.

There have been some private letter rulings issued by the IRS to allow a rollover to a surviving spouse’s IRA under certain circumstances. However, I wouldn’t bank on a Private Letter Ruling (PLR), and you probably won’t want to either after you research the costs involved and the fact that acceptance is not guaranteed.

Option #2: Keep The IRA as an “Inherited IRA” aka “Beneficiary IRA”

If you choose to leave the IRA in your spouse’s name and treat it as an inherited IRA, you may have to begin taking RMDs rather quickly depending on the age of the deceased.

This can be a benefit or a boon, depending on your exact situation.

When a surviving spouse decides to keep an account as an inherited IRA, different rules apply depending on whether the deceased IRA owner died before the deceased owner’s required beginning date (RBD) or, on/after their required beginning date.

This is where things start to get a little tricky, as you’ll see later.

The inherited IRA in these cases would be in the deceased’s name, but for your benefit. This might look something like: “John Doe IRA (deceased June 15th, 2024), FBO (for the benefit of) Jane Doe, Beneficiary”.

In these cases, it is crucial to make sure that your brokerage or investment custodian changes the Social Security number on the account to the surviving spouse beneficiary’s (yours) – even if it is being kept as an inherited IRA.

This is because any money coming out of this inherited IRA is taxable to the surviving spouse – the new owner – and 1099-R tax forms sent by the investment custodian need to be accurate.

A surviving spouse who elects to treat the IRA as an inherited IRA has a few options regarding how and when they will take their RMDs:

- Inherited IRA with Required Minimum Distributions (RMD) stretched over life expectancy

- Section 327 Election – Elect to be treated as deceased spouse (may be an automatic/default election)

- 10-year rule

Inherited IRA with RMDs Stretched Over Life Expectancy

If the 10-year rule is not elected, a surviving spouse beneficiary in this situation generally must begin RMDs by the later of:

- December 31st of the year after the year your spouse passed away, or

- December 31st of the year your spouse would have reached their RMD age (73 or 75).

This is a unique rule because it can be used strategically to delay RMDs if the IRA owner dies before their RMD age of 73/75.

When the IRA owner dies before their RBD:

The surviving spouse will need to begin taking RMDs by December 31st of the year the deceased spouse would have reached their RMD age (73 or 75).

However, the Secure Act 2.0 brought a new twist to how spouses may choose to calculate their RMDs which may benefit those in certain situations.

This is known as the Section 327 election (sometimes called the “spousal election”) which allows allows a surviving spouse to elect to be treated as the deceased spouse for RMD purposes.

The latest regulations say that 327 can be used (if allowed by the employer plan or IRA documents) when the deceased spouse dies before, on, or after his or her RBD.

If the deceased spouse dies before their RBD, the 327 election to be treated as the deceased spouse for RMD purposes is typically automatic or elected by default. However this will ultimately depend on the investment custodian’s IRA document.

When this election is applied and the deceased passed before their RBD, it allows a surviving spouse to delay RMDs until the deceased would have reached their RMD age, but instead of calculating the RMD based off of their own age on the Single Life Expectancy Table, they calculate their RMDs based on their own age/life expectancy via the Uniform Life Expectancy Table and recalculates annually.

This can be a good idea to elect if the surviving spouse is older than the deceased spouse.

This is because the older survivng spouse could delay the RMD for years to come depending on the age of the younger spouse, and the Uniform Life Table allows for smaller RMDs than the Single Life Table when they do eventually begin.

Example: Sandra passes away in 2024 at age 65 and her older spouse Fred – age 75 and the sole beneficiary- takes on the account as an inherited IRA rather than treat as his own or roll it over.

By doing so, Fred can delay taking RMDs until Sandra would have reached age 73 – which would make him 83 years old.

If he were to have rolled the inherited IRA to his own or treated it as his own IRA, he would have had to begin taking RMDs by December 31st of the following year.

If Fred chose to stick with the automatic 327 election, when he begins RMDs at age 83, he would use the Uniform Life Table to calculate the RMD using his own age.

The life expectancy factor for a 83 year-old using the Uniform Life Table is 17.7. This will result in a much lower RMD than the life expectancy factor for an 83 year-old using the Single Life Table which is 9.3, had he elected out of section 327.

If the surviving spouse elects out of the 327 election, they will still use their own age when calculating RMDs but instead will be referring to the Single Life Expectancy Table. When using the table, he or she will refer to the age they will reach by the end of that year.

The factors on the Single Life Table result in larger RMDs then the Uniform Life Table. Therefore there is little to no reason to elect out of section 327.

When the IRA owner dies on/after their RBD:

The surviving spouse will begin taking RMDs by December 31st of the year after their spouse’s death and generally use the longer life expectancy of :

- The surviving spouse’s own age when referring to the Single Life Expectancy Table to calculate their RMD. He or she will refer to the age they will reach by the end of that year. When a spouse uses the Single Life Table, they are able to “recalculate” each year by referring to their new age each year on the table and applying the corresponding factor.

- The deceased spouse’s age when referring to the Single Life Expectancy Table to calculate their RMD. When using the Single Life Table and the deceased spouse’s age, the surviving spouse beneficiary will refer to the age the deceased spouse would have reached by year-end and applying the corresponding factor. Each year thereafter, they will reduce that initial factor by 1. They will not “recalculate” each year.

If the deceased spouse dies after their RBD, the 327 election to be treated as the deceased spouse for RMD purposes is NOT automatic.

If the IRA owner dies on or after their RBD, and the surviving spouse elects to be treated as the deceased spouse under section 327, this allows the surviving spouse to determine RMDs by using the longer life expectancy of :

- The surviving spouse’ s own age using the Uniform Life Table (recalculated annually), or

- The remaining life expectancy of the deceased spouse from the Single Life Table (reduced each year thereafter by 1).

Example 1: Gerald dies at age 80 in 2024. His wife, Susan, age 75, is his sole IRA beneficiary. If Susan makes a section 327 election (keeps the account as an inherited account), she will need to take her first RMD in 2025.

She must use a 23.7 factor, which is the longer of the factors using her age (76) and the Uniform Lifetime Table (23.7), or Gerald’s remaining single life expectancy under the Single Life Table, which is 10.2 (11.2 – 1= 10.2).

Note: The 23.7 factor would be the same factor that Susan would use if she does a spousal rollover to her own IRA.

Example 2: In 2024, Patricia dies at age 74. Her husband, Raymond, age 90, is her sole IRA beneficiary.

If Raymond makes a section 327 election, he can take his first RMD from the inherited account in 2025 using Patricia’s remaining single life expectancy under the Single Life Table, which is 14.6 (15.6 – 1 = 14.6).

This would result in a smaller RMD than if he did a spousal rollover to his own IRA because the life expectancy from the Uniform Lifetime Table for age 91 is 11.5.

Remember: A surviving spouse can always roll their inherited IRA from a spouse into their own IRA at a later point if it is more beneficial for their situation.

10-Year Rule

As mentioned previously, a spouse as a beneficiary is an eligible designated beneficiary or EDB. An EDB can elect what is called the “10-year payout rule” if the original IRA owner died before his or her RBD.

However, one of the benefits of being an EDB in the first place is that you are not forced to follow the 10-year rule and be required to completely drain the IRA in 10 years, so why do this? The previous options are typically the better route to go as a surviving spouse.

Note: There is also a special rule requiring that “hypothetical retroactive RMDs” be taken when a spouse elects the 10-year rule and then later does a spousal rollover – crazy, I know. Best to consult a financial advisor if this is your situation.

Planning Opportunities When Inheriting an IRA From a Spouse

Depending on your situation, keeping the inherited IRA in the deceased’s name could be more beneficial than treating the IRA as your own.

An example of this may be a case in which you are younger than your deceased spouse and in need of extra income before you reach age 59.5.

This “unlocks” the ability to take distributions from the IRA without the 10% early withdrawal penalty since this rule doesn’t apply to distributions from inherited IRAs.

As discussed previously, as a spouse (and only as a spouse) you are allowed to rollover your inherited IRA to your own IRA later in life if it makes sense per your articular situation. This opens the door for many planning opportunities. Remember, you can’t do this the other way around.

Example: Let’s say you are age 51, your spouse dies at the young age of 55, and you as a spouse kept the IRA as an inherited IRA in your deceased spouse’s name.

You can delay those RMDs for two decades to keep the investments growing for you tax deferred.

Then, once the deceased would have reached their RBD (age 75 in this example), you can decide to roll the inherited IRA to your own IRA and delay the RMDs even further until you reach your required beginning date 4 years later! Crazy right??? We hope you find this as fascinating as we do.

Why would you choose to make this an inherited IRA at first?

In this example, if you needed money at any time before age 59.5, you would have been able to access it and would never have paid a 10% early withdrawal penalty on any of the inherited money!

Then once you roll it to your own IRA, you delay the RMDs further until your RBD of 75 (four years later) but can still take money without a 10% penalty because you would be over 59.5 at that point!

On the flip side, if you are older than your deceased spouse and decide to take the account on as an inherited IRA, you can leave it as an inherited IRA without rolling it over to your own later and defer the RMDs as long as possible if it makes sense for your specific tax situation.

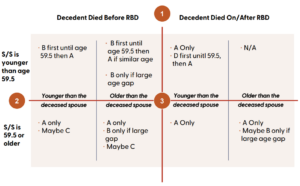

Use this chart to help summarize your potential planning options:

The letters in the chart correspond to the options listed below.

A: Spousal IRA Rollover (Deceased spouse died before or after RBD)

B: Inherited Stretch (Automatic election – Deceased spouse died before RBD)

C: Inherited 10-Year Rule (Deceased spouse died before RBD only)

D: Inherited Stretch (Election required – Deceased spouse died on/after RBD)

Keep in mind that the benefit of deferring RMDs can be offset by the fact that they may be larger than they would have been initially when they eventually do begin.

This is due to the fact that the surviving spouse will inevitably get older, which will affect the factor from the life expectancy tables resulting in a larger RMD amount (unless we are talking about Benjamin Button).

In addition, depending on how the account is invested and for how long, sometimes the account growth alone can be significant!

Therefore, deferring distributions may not always make the most sense sense. Especially if the surviving spouse can take money from the IRA in years with little to no other income, resulting in a smaller tax bill vs taking more money later.

Taking all of the money as late as possible could trigger many other tax issues during retirement years such as surcharges on Medicare B and D premiums (IRMAA), extra taxation of Social Security, phasing out on being able to deduct some rental real estate losses, potentially higher tax brackets and rates, etc.

Not-So-Common Sense Tip: It’s always best to buy the government’s share of your IRA at the lowest cost…

Therefore, even if you can defer RMDs, you may not want to, and in cases where you have to take an RMD, you may want to take more than the minimum to maximize your particular tax situation.

And for those surviving spouses who have a longer investing time horizon, you may want to consider rolling or treating the IRA as your own so that you can begin gradually converting the money to a Roth IRA over several years.

Depending on your situation, this could dramatically improve your financial plan over your remaining lifetime. Why do the rollover in this case? Because you cannot convert money in inherited IRA accounts to a Roth.

Year-of-Death RMD Reminder

If your spouse passed away after their own required beginning date – meaning they were required to take an RMD or had been taking them in years past, and had not yet taken their RMD in the year of death, the beneficiary (including a spouse) must take the RMD on their behalf.

This is known as a “year-of-death RMD”.

This RMD needs to be taken by the beneficiary(ies) by December 31st of the year after the year of death, and it is taxable to the beneficiary.

There are new guidelines on how this final RMD is calculated and distributed dependent upon the number of IRAs involved and different beneficiaries – consult a professional if you have a complicated situation.

After that is satisfied, any RMDs would depend upon how the surviving spouse chose to take on the IRA given the options mentioned previously.

Download PDF Flowchart: Inheriting an IRA From Your Spouse

Click here to sign up for our Retired·ish newsletter to receive your free PDF guide for 2025 regarding inheriting an IRA from your spouse.

The Bottom Line

These rules are for spousal beneficiaries only. The rules get slightly more complicated for non-spouse beneficiaries – as if this wasn’t complicated enough!

In addition, certain IRA documents from various investment custodians may have default language such as whether or not a section 327 election is used by default, which can limit how a surviving spouse will need to take required minimum distributions.

Therefore, always consult your custodian’s specific IRA documents. If you find language that is less than ideal, you might consider rolling the money to an invest custodian with more preferential distribution language.

Cameron Valadez is a CERTIFIED FINANCIAL PLANNER™ and Enrolled Agent in Riverside and Orange County, California.

He is the host of the Retired·ish Podcast for pre-retirees and retirees age 50+ and author of “Finding Financial Clarity & Confidence When Starting Over”, a book for women who are suddenly responsible for their own financial security (not for sale – available free upon request).

Disclosures:

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.

This information is for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Distributions from earnings are not subject to the 10% penalty if you qualify for an IRS exception — please consult with your tax advisor for details. Distributions from a conversion amount must satisfy a five-year investment period to avoid the 10% penalty. This pertains only to the conversion amount that was treated as income for tax purposes.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.