Get Your Free

Tax-Optimized Retirement Playbook™

A 3-step process that gives you the ability to evaluate our firm and make an informed decision about working with us to optimize your tax and financial situation in retirement.

There is no cost or obligation to go through these steps as we want you to know how we can add value to your situation before you make a decision.

Your custom playbook will address how much you can spend in retirement given your unique goals, a tax return analysis with insights to reduce your lifetime tax bill as much as possible, as well as a full investment analysis that aims to improve risk-adjusted returns.

step 1

Schedule a Discovery Meeting With Our Team

(45-Min via phone call or zoom)

We want to get to know you! This is also an important first step in making sure your situation and goals are a good fit for our expertise.

We will spend the first 15-minutes of this meeting ensuring your situation matches our expertise.

If we mutually agree there is a potential fit, we will spend the remaining time together learning more about you and your unique challenges.

If we aren't a good fit, we will do our best to point you in the right direction and help you find another firm who is!

step 2

Share Documents & Necessary Information

After our Discovery Meeting, we will securely request a few important documents and other necessary information from you.

These documents, along with the goals and information you share with us in your Discovery Meeting, will be the foundation upon which we design your Tax-Optimized Retirement Playbook™.

step 3

Review Your Tax-Optimized Retirement Playbook™

(1-hour via Zoom)

During this meeting, we will deliver the results of your Tax-Optimized Retirement Playbook™.

Our analysis will help answer:

- How can your current retirement income plan be improved?

- What can you do to lower your lifetime tax bill?

- How can your investments and allocation be optimized for your specific goals?

- How might you be able to further improve your legacy plan for your family?

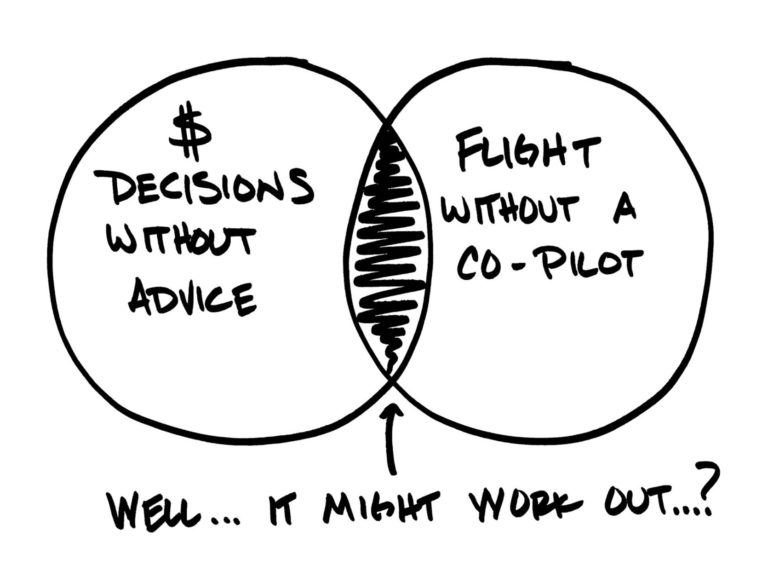

Tackling retirement planning on your own can be daunting, and is very time consuming.

We understand that your time is your most valuable asset, and our role is to help you keep more of it.

![]()

FAQ

How do we make a living?

By following our 3-step process above, you'll have the play-by-play on what you need to do going forward regardless of whether or not you work with our firm.

You can choose to execute your playbook on your own, or have us do what we do best.

If you decide you would like us to design, implement, and monitor our ideas and strategies:

We charge a tiered, quarterly fee, assessed as a percentage of the investable assets we manage in order to implement your entire retirement plan.

- Since we serve as fiduciaries for our advisory clients, our long-term success is automatically tied to your portfolio’s long-term success - this keeps interests aligned and means we stand by our recommendations.

- If you have questions, you can see your investment returns and advisory costs with our transparent reporting.

No hidden charges or fees. Just full transparency. We like it that way – and we know you will too.

A fiduciary is a professional who is obligated to put clients’ interests ahead of their own. Yes, all advisors at Planable Wealth serve as fiduciaries for advisory clients.

Financial planners/advisors, tax professionals, and attorneys provide different types of advice that is specific to a particular need.

For example:

- A licensed tax preparer or accountant is able to complete a client's tax return on their behalf.

- A licensed estate planning attorney can draft a client's health directives, powers of attorney, and trusts.

- A licensed financial advisor can provide investment advice and recommendations.

- A tax preparer typically "looks in the rearview mirror" and prepares your taxes based on the previous year.

- A financial advisor may "look ahead" at potential tax impacts and considerations you may want to plan for in order to help reduce future tax obligations.

When a client engages us to create and implement a financial plan, we design the strategies that address retirement income, investing, future tax planning, and estate planning considerations.

Once we have created these strategies, we will call in the tax professionals and attorneys as needed to implement their part!

We have the ability to work closely with our client's current professionals, or we can refer to qualified professionals if needed.

Most people think all financial planners are “certified,” but this isn’t true. Just about anyone can use the title “financial planner.” CFP Board benefits the public by independently certifying financial planners.

Although CFP Board does not guarantee their work, CFP® professionals have met rigorous qualifications for financial planning.

Only those who have fulfilled CFP Board’s rigorous requirements can call themselves a CFP® professional.

As part of their certification, CFP® professionals commit to high ethical standards. What’s more, a CFP® professional must acquire several years of experience related to delivering financial planning services to clients and pass the comprehensive CFP® Certification Exam before they can call themselves a CFP® professional.

Working with a CFP® professional can help you find the path in pursuit of your financial goals. Your goals may evolve over the years as a result of shifts in your lifestyle or circumstances such as an inheritance, career change, marriage, house purchase or a growing family.

As you begin to consider how best to manage your financial future, you should feel confident knowing that with a CFP® professional, you’re working with someone who has committed to CFP Board, as part of their certification, that they will act as a fiduciary, and therefore, act in their client’s best interests, at all times when providing financial advice to a client.

CFP Board doesn’t guarantee a CFP® professional’s services, but CFP Board may sanction a CFP® professional who does not abide by this commitment.

From <https://www.letsmakeaplan.org/how-to-choose-a-planner/why-choose-a-cfp-professional>