In this blog post, we will explore the financial considerations involved in “snowbirding” during retirement.

Snowbirding, which involves splitting time between two homes in different locations, offers retirees the opportunity to enjoy the best of both worlds when it comes to comfort and climate.

However, before embarking on this lifestyle, it is crucial to understand the financial implications and make well-informed decisions.

In this condensed article, we introduce the financial aspects of snowbirding at a high level and provide valuable insights to help you make a better decision in planning your retirement.*

*For a more in depth dive on the financial aspects of snowbirding in retirement, listen to our podcast episode HERE.

Benefits of Snowbirding:

Retirees often choose to snowbird to escape extreme weather patterns and enjoy a change of scenery during the colder months.

By having multiple homes or alternative housing arrangements such as a condo, boat, or RV, retirees can add excitement to their retirement years.

Snowbirding provides the freedom to get away when the cold weather sets in and return when it’s more comfortable.

Considerations for Choosing a Second Residence:

When selecting your second residence, you can focus less on factors like school districts and commuting convenience since the kiddos are more likely to have left the nest.

This opens up opportunities to explore locations with lower property taxes and living costs.

You’ll want to consider finding like-minded communities and accessible healthcare services.

Additionally, it is essential to choose a living situation that will provide emotional comfort and stability in the long run.

Financial Considerations of Snowbirding:

1. Buying vs. Leasing:

Before committing to purchasing a second home, consider leasing or renting initially. This allows you to test the snowbird lifestyle and determine if it aligns with your desires and can potentially save you a significant amount of money in the long-run

Leasing eliminates the responsibilities of property maintenance and repairs, reducing upfront costs. However, owning a property offers advantages such as a permanent residence, building equity, and potential rental income.

2. Establishing Residency:

Being mindful of residency requirements is crucial when snowbirding.

Establishing residency in a new state involves various considerations such as: owning a home, changing driver’s license and voter registration, shifting business operations, and joining local organizations to name a few.

Understanding each state’s specific laws and consulting an attorney are essential to ensure compliance with the state tax authorities.

3. Additional Expenses:

Snowbirding incurs additional costs beyond just property taxes.

Homeowner’s insurance for the property you spend less time in might be higher due to concerns about property maintenance while you are away such as mold or cracking.

Other expenses to consider are lawn care, HOA dues, snow removal, utilities for both properties – yes heating and air will likely still need to run even when you’re away, and potential costs associated with property management if renting a property out on a short-term basis while you’re away.

4. Travel and Transportation:

Budgeting for travel expenses between your two residences is essential.

Taking into account gas or airfare costs, as well as frequency of travel, will help you align your financial plan accordingly.

Healthcare Considerations:

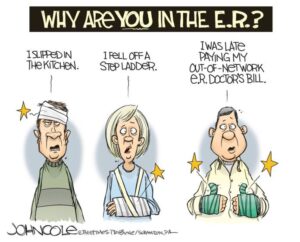

When it comes to healthcare, it’s important to evaluate your insurance coverage in both locations.

If you are not yet eligible for Medicare, ensuring your health insurance covers you both states is vital to avoid unexpected out-of-pocket expenses.

For instance, if you have an HMO plan that only covers the majority of costs within a certain medical provider network, what happens if something goes wrong while your at your other home outside of the network?

If you are on Medicare, consider supplement plans that offer coverage in both areas.

Coordination between healthcare providers in different states is also crucial for ongoing treatments or regular medical check-ups for chronic conditions.

The Bottom Line:

Snowbirding can be an exciting and fulfilling way to enjoy retirement, offering the freedom to switch between different locations and climates.

However, it is essential to consider the financial implications and plan accordingly.

From determining whether to buy or lease a second property to understanding residency requirements and managing additional expenses, thorough financial planning is crucial for a successful snowbird lifestyle.

By working closely with your financial, legal, and tax advisors, you can make informed decisions and enjoy the fruits of a well-prepared retirement.

For a more in depth dive on the financial aspects of snowbirding in retirement, listen to our podcast episode HERE.

Remember, if you need comprehensive retirement planning assistance and guidance throughout this process, our firm, Plannable Wealth, specializes in helping individuals over 50 with their retirement plans.

Reach out to us for a free consultation and personalized planning HERE.

Happy snowbirding!

Cameron Valadez is a CFP® Practitioner in Riverside and Orange County, California.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

This is meant for educational purposes only. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific tax issues with a qualified tax or legal advisor.