Social Security Benefits and Divorce

If you’re looking for a guide to answer your questions about Social Security and divorce

For those of you who part ways in your 50’s and 60’s, Social Security is one of those permanent decisions that you will want to understand thoroughly before making. It is a big question mark for most because of the many rules and qualifications. Furthermore, the rules can and do change.

If you are a divorcee, you may be eligible for benefits based on your ex-spouse’s earnings record.

However, Social Security won’t be the only important decision hanging around in your head. There are a myriad of ways your financial life will change and it is helpful to know what to be prepared for.

Post-separation, here are some things you may experience or need:

- The need for some sort of financial “roadmap”

- Working while collecting Social Security

- Decision making regarding the division of assets such as real estate, retirement accounts, etc.

- Managing assets on your own

- Analyzing heath care needs and costs

- Communication among attorney, tax preparer, and financial planner

- Income planning (including potential child support and alimony)

- Changes to your tax situation – higher taxes post-divorce is very common

- Changes to your estate plan and the people involved (will, trust, power of attorney, healthcare directive)

Social Security Eligibility

First, you have to determine if you are eligible to receive any benefits from Social Security. If you have worked enough throughout your lifetime (40 credits/10 years) you will be eligible for your own retirement benefit. However if your ex-spouse is eligible for their own benefits as well, you may be eligible for an amount based on their benefit (aka: ex-spousal benefit).

This can be beneficial to you if your ex-spouse had significantly higher earnings over their working lifetime, or if you did not accumulate enough lifetime credits to be eligible for your own benefits. Yes you read that correctly; if you didn’t work, or at least not long enough to earn 40 credits, you may still be able to collect a benefit based on your ex-spouse’s Social Security benefit.

The maximum amount of Social Security benefits you can receive based on an ex-spouse’s record is 50% of what your ex-spouse would get at their Full Retirement Age.

You will often hear or see the term “Full Retirement Age (FRA)“, which refers to the age you become eligible to receive your full (unreduced) retirement benefit from Social Security. It is imperative to know what your FRA is in order to make decisions regarding Social Security. You will also want to know your ex-spouse’s FRA as well.1

Your FRA depends on the year you were born

| Year of Birth | Full Retirement Age |

| 1943-1954 | 66 Years |

| 1955 | 66 Years and 2 Months |

| 1956 | 66 Years and 4 Months |

| 1957 | 66 Years and 6 months |

| 195 | 66 Years and 8 Months |

| 1959 | 66 Years and 10 Months |

| 1960 | 67 Years |

*Those born prior to 1943 have different FRAs. Please visit the Social Security website for more information.

Ex-Spousal Benefit Eligibility

If you are divorced but your marriage lasted 10 years or longer, you can receive benefits based on your ex-spouse’s record (even if they have remarried) if you meet the following requirements:

| Requirements | |

|---|---|

| Your Age | 62 or older |

| Your Current Marital Status | Unmarried |

| Your Ex-Spouse |

At least age 62 or disabled:

|

| Both of You Worked (40 credits) |

|

Your maximum benefit as a divorced spouse is equal to 50% of your ex-spouse’s full retirement amount, if you start receiving benefits at your full retirement age.2 If you decide you want to take ex-spousal benefits before your FRA, your ex-spouse must also be at least age 62 (eligible). The earliest you can take the benefits is age 62, but note that the benefits will be permanently reduced.*

*If you will also receive a pension based on work not covered by Social Security – such as government work – your Social Security benefit based on your ex-spouse’s record may be affected.

If eligible for both your own benefit and an ex-spousal benefit, you cannot double-dip and collect your own retirement benefits and a benefit based on your ex’s record. You can receive whichever benefit is higher unless you are eligible to file a restricted application which we will discuss later.

If you do end up receiving a benefit based on your ex’s record, it will not affect amounts they can receive or are currently receiving from Social Security – Sorry, no revenge!

For Example:

You are eligible for ex-spousal benefits and you decide to take them at age 62 (ex-spouse is also at least 62). You will receive a reduced benefit (less than the 50% of your ex’s full benefit). If let’s say your reduced benefit equals 35% instead of the full 50%, the percentage will not increase up to the 50% max as you get older.

This is a common misconception. Once you decide to take a reduced benefit that’s it, the decision is permanent.

The benefits will not include any delayed retirement credits your ex-spouse may receive. Delayed retirement credits are those credited for each year an individual delays taking benefits past their full retirement age and the credits stop at age 70. The percentage credited depends on the year you were born, but is an 8% increase per year for most.

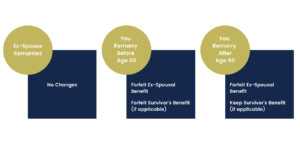

Remarriage After Divorce

What happens to your Social Security benefit if after you divorce you were to get remarried?

One exception to the chart above:

If you remarry, your ex-spousal benefit will end unless your new spouse is also receiving either an ex-spousal benefit or survivor benefit.

On the contrary if the new spouse is already collecting their own benefit, you can switch to a spousal benefit based on their record (if higher) once you have been married to them for at least one year. If your second marriage ends via divorce or death, you may become re-eligible for benefits based off of your first marriage if necessary.

If your second spouse passes and you were married for at least 9 months, you will be eligible to receive a survivor benefit on their record which can include any applicable delayed credits!

Planning Tip: If you are planning to remarry, you may want to wait until after age 60. The reason is that if your ex-spouse predeceases you, you can still be entitled to a survivor benefit based on their record.

This strategy would only be beneficial if that survivor benefit was larger than all other benefits you are eligible for. Remember you can only collect one benefit, whichever is largest.

Restricted Application

If you were born before January 2, 1954 and have already reached full retirement age, you can choose to receive only your ex-spouse’s benefit and delay receiving your own retirement benefit until a later date using a restricted application (widows and widowers may continue to use a restricted application at any claiming age).

This strategy allows you to accumulate delayed credits on your own benefit and switch to it later (up to age 70), and is only possible if you have not already begun taking your own benefits.

If you are divorced, haven’t yet started collecting your own benefits, and you were born before January 2nd, 1954, you still have time to file a restricted application. This could open the door to additional income based on an ex-spouse’s record until you start collecting your own higher benefits. This is one of the best Social Security strategies still hanging around, especially if your situation involves a divorce.

If your birthday is on January 2, 1954 or later, you cannot file a restricted application. As a result of the Bipartisan Budget Act of 2015, once you file for either your own benefit or a spousal/ex-spousal benefit it is now called “deemed filing”.

This means that when you apply for one benefit you are “deemed” to have also applied for the other (cannot take ex-spousal now and delay your own benefit for later years). You can no longer file a restricted application if born on or after 1/2/1954.3

Planning Tip: If you are considering filing a restricted application with the Social Security Administration over the phone or in person, it is a good idea to ask for a supervisor. Turnover in Social Security offices is high and you want to make sure you are speaking with someone that understands exactly what are trying to do.

If you are doing it yourself online, it is crucial you answer certain questions correctly and note that you wish to file a restricted application. It can also benefit you to mention that you currently only want to take spousal/ex-spousal benefits, and wish to accumulate delayed credits on your own benefit as well.*

*A surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment.

Working and Collecting Social Security

You can continue to work while receiving Social Security benefits but know that there is a retirement benefit “earnings limit” that may apply. The rules regarding working and collecting Social Security don’t change if you divorce.

If you are younger than full retirement age, taking benefits, and make more than the yearly earnings limit, your earnings may reduce your benefit amount as follows:

- If you are under full retirement age for the entire year: Social Security deducts $1 from your benefit payments for every $2 you earn above the annual limit. For 2021, that limit is $18,960.

- In the year you reach full retirement age: Social Security deducts $1 in benefits for every $3 you earn above a different limit. In 2021, the limit on your earnings is $50,520 but they only count earnings before the month in which you reach your full retirement age.

- When you reach full retirement age: Beginning with the month in which you reach your FRA, your earnings no longer reduce your benefits, no matter how much you earn. Once you reach your FRA, your payments will be adjusted and you will start to receive the money back that was withheld previously. Not all is lost!

Income from other pensions, interest/investment earnings, annuities, and capital gains are not counted towards the earnings limits. W-2 wages and net earnings (from self-employment) are counted.

The Bottom Line

- There’s many doors to Social Security and the right one to enter depends on your specific situation.

- A divorce later in life or “grey divorce” can really muddy up your finances, therefore making a good Social Security decision is paramount to your financial success.

- Although it may feel like it, you aren’t alone! For help making an informed decision, contact us and we will gladly offer our experience and tools to you.

Updated as of 10/10/2021

Cameron Valadez is a CERTIFIED FINANCIAL PLANNER™ located in Riverside and Orange County, CA.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

This is meant for educational purposes only. It should not be considered financial advice, nor does it constitute a recommendation to take a particular course of action. Please consult with a financial professional regarding your personal situation prior to making any financial related decisions. Planable Wealth does not offer tax or legal advice.

1 https://www.ssa.gov/planners/retire/retirechart.html

2 https://www.ssa.gov/planners/retire/divspouse.html

3 https://www.ssa.gov/planners/retire/claiming.html